XRP Price Prediction: Will It Reach $3 Amid Current Volatility?

#XRP

- Technical Consolidation: XRP is trading below its 20-day MA, signaling short-term bearish pressure but with MACD hinting at a possible turnaround.

- Market Sentiment: Mixed news—Ripple's strategic moves counterbalance IPO speculation, creating neutral-to-bullish sentiment.

- Price Target: A breakout above 2.7057 could fuel momentum toward $3, though broader market conditions remain pivotal.

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

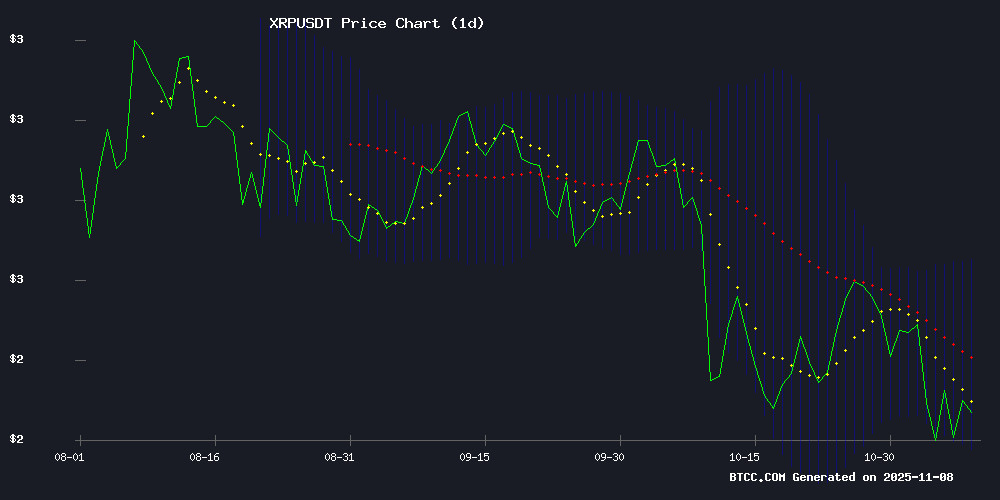

According to BTCC financial analyst Sophia, XRP is currently trading at 2.3111 USDT, below its 20-day moving average (MA) of 2.4448. The MACD indicator shows a slight bullish crossover with a value of 0.0229, while the Bollinger Bands suggest a potential range between 2.1838 (lower band) and 2.7057 (upper band). These indicators point to a consolidation phase, but the MACD's positive momentum could signal an upcoming reversal if buying pressure increases.

XRP Market Sentiment: Mixed Signals Amid Consolidation

BTCC financial analyst Sophia notes that recent news highlights both bullish and bearish factors for XRP. While some analysts speculate about Ripple's government ties and long-term dominance, the company's leadership has downplayed IPO rumors, focusing instead on buybacks. This mixed sentiment aligns with the technical outlook, suggesting cautious Optimism for a potential breakout if broader market conditions improve.

Factors Influencing XRP’s Price

XRP Price Prediction: Key Metrics Point to Trouble – But Could This Be the Final Dip Before a Reversal?

Retail demand for XRP remains suppressed, while on-chain activity continues to decline, creating headwinds for bullish price predictions. Broader market uncertainty—driven by U.S. government shutdown fears and slowing growth concerns—has further dampened sentiment. Derivatives data from Coinglass reflects this downturn, with open interest plummeting to $3.37 billion, a level last seen before the bull run began.

Network activity on the XRP Ledger has also slumped, with daily unique addresses dropping 18% to 54,000, according to Glassnode. New address growth has been erratic, crashing 60% to 4,770 in a single day. Despite Ripple's announcement of $500 million in new funding to bolster institutional partnerships and ecosystem development, retail liquidity remains elusive.

Traders appear to be sidelining XRP, possibly awaiting stronger market signals before re-entering. However, a potential reversal could emerge if the current retest of a three-month descending channel holds, reigniting breakout speculation.

Analyst Claims XRP Ledger Was Built by US Government, Positioning Ripple for Dominance

An anonymous analyst known as unknowDLT has sparked controversy with a theory that the XRP Ledger was secretly developed by the U.S. government rather than merely adopted by it. The claim, circulating on social media platform X, suggests Ripple's blockchain exhibits characteristics atypical of private crypto projects—speed, compliance, and global interoperability—aligning more closely with central banking infrastructure.

"Ripple wasn't chosen; it was built," the analyst asserted, framing XRP as a potential geopolitical instrument to reinforce dollar supremacy. While unsubstantiated by official records, the theory implies Ripple's regulatory resilience stems from covert institutional backing. This narrative, if validated, could redefine XRP from a utility token to a strategic asset in the digital currency cold war.

Ripple President Disputes IPO Plans, Says Company Well-Capitalized

Ripple President Monica Long has firmly dismissed speculation about an imminent initial public offering, stating the blockchain payments company has "no plans or timeline" for going public. The clarification came during Ripple's Swell conference in New York, where Long emphasized the company's strong financial position.

"We've been able to fund all our organic growth, inorganic growth, and strategic partnerships internally," Long told Bloomberg. The statement echoes previous comments from CEO Brad Garlinghouse about Ripple's ability to operate without external investment.

Despite recent reports of a $500 million funding round valuing Ripple at $40 billion, Long maintains the company faces no financial pressure to pursue an IPO. The funding was led by prominent firms including Fortress Investment Group and Citadel Securities.

Ripple CEO Dismisses IPO Urgency Amid Aggressive Buyback Strategy

Ripple CEO Brad Garlinghouse reiterated the company's lack of urgency for an initial public offering during a discussion at Pantera’s Blockchain Summit 2025. Despite aggressive share buybacks and fresh capital injections, Garlinghouse emphasized that Ripple has no immediate plans to go public. The company has repurchased over 25% of its shares, spending $4 billion to buy back equity from shareholders, including a recent $1 billion tender offer that values Ripple at $40 billion.

Garlinghouse framed the buyback strategy as a deliberate alternative to public listing, drawing parallels to SpaceX’s approach. "We haven’t needed to go public, and so we haven’t prioritized that," he said. The $40 billion valuation aligns with recent disclosures, including a $500 million investment secured earlier this week. Ripple’s focus remains on private-market liquidity solutions, sidelining traditional IPO routes for now.

Will XRP Price Hit 3?

Sophia from BTCC highlights that XRP's path to $3 depends on overcoming key resistance levels. Below is a summary of critical metrics:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | 2.3111 USDT | Below 20-day MA |

| MACD | 0.0229 (bullish) | Potential reversal signal |

| Bollinger Bands | 2.1838–2.7057 | Range-bound trading |

A sustained push above the upper Bollinger Band (2.7057) could open the door for a rally toward $3, but this requires strong bullish catalysts.